Budgeting is the foundation of financial success. It allows you to take control of your money, prioritize your expenses, and work towards your financial goals. Whether you’re aiming to pay off debt, save for a down payment, or build an emergency fund, implementing smart budgeting strategies is crucial. In this blog post, we will explore effective techniques that can help you master the art of budgeting and achieve financial success.

Track Your Income and Expenses

The first step in budgeting is to gain a clear understanding of your financial situation. Start by tracking your income and expenses for a month. This will help you identify where your money is going and highlight areas where you can make adjustments.

Set Financial Goals

To stay motivated and focused, it’s important to set specific financial goals. Whether it’s saving for retirement, buying a house, or taking a dream vacation, having clear goals will give your budgeting efforts purpose and direction.

Differentiate Between Needs and Wants

Distinguishing between needs and wants is essential for effective budgeting. Prioritize your needs such as housing, utilities, groceries, and transportation, and allocate a portion of your income towards them. Evaluate your wants and identify areas where you can cut back or find more affordable alternatives.

Create a Realistic Budget

Based on your income, expenses, and financial goals, create a realistic budget that balances your income and expenditure. Allocate money for essential expenses, savings, debt repayment, and discretionary spending. Ensure that your budget allows for some flexibility and includes a buffer for unexpected expenses.

Utilize Budgeting Tools and Apps

Leverage the power of technology by using budgeting tools and apps to simplify the process. Platforms like Mint, YNAB (You Need a Budget), or Personal Capital can automatically track your expenses, categorize them, and provide insights into your spending habits. These tools can help you stay on top of your budget and identify areas for improvement.

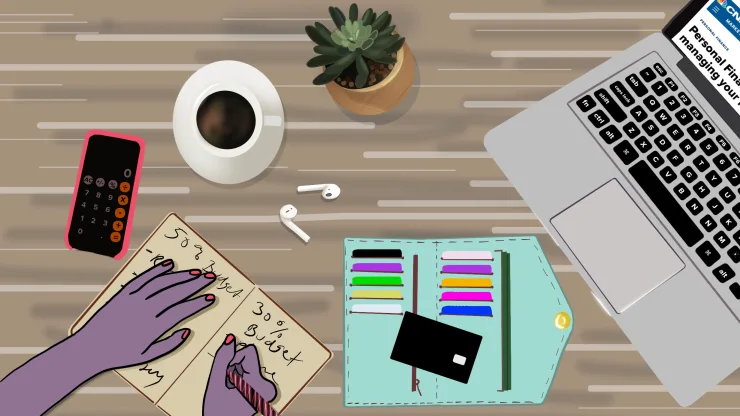

Implement the 50/30/20 Rule

One popular budgeting rule is the 50/30/20 rule, which suggests allocating 50% of your income towards needs, 30% towards wants, and 20% towards savings and debt repayment. Adjust the percentages based on your priorities and financial goals, but aim to strike a balance between immediate enjoyment and long-term financial security.

Use Cash Envelopes

If you struggle with overspending, try the cash envelope system. Allocate specific amounts of cash to different spending categories (e.g., groceries, entertainment) and place them in labeled envelopes. This tangible method encourages conscious spending and keeps you accountable.

Review and Adjust Regularly

A budget is not set in stone; it should evolve as your financial situation and goals change. Review your budget regularly and make adjustments as needed. Track your progress, celebrate milestones, and make refinements to ensure that your budget aligns with your financial aspirations.

Automate Your Savings

Make saving a priority by automating your savings. Set up automatic transfers from your checking account to a dedicated savings account each month. This removes the temptation to spend the money and ensures that you consistently contribute towards your financial goals.

Seek Professional Guidance

If you find budgeting overwhelming or need expert advice, consider consulting a financial planner. They can provide personalized guidance, help you optimize your budget, and offer strategies to maximize your financial potential.

Conclusion

Smart budgeting is the cornerstone of financial success. By tracking your income and expenses, setting clear goals, distinguishing between needs and wants, creating a realistic budget, and utilizing budgeting tools, you can take control of your finances and achieve your financial aspirations. Remember to review and adjust your budget regularly, automate savings, and seek professional guidance when needed. With these strategies in place, you’ll be on your way to a more secure and prosperous financial future.